P/E ratio

The P/E ratio (price-to-earnings ratio) of a stock (also called its "P/E", or simply "multiple") is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share.[2] The P/E ratio can therefore alternatively be calculated by dividing the company's market capitalization by its total annual earnings.

Unlike the EV/EBITDA multiple which is capital structure-neutral, the price-to-earnings ratio reflects the capital structure of the company in question. The price-to-earnings ratio is a financial ratio used for valuation: a higher P/E ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with a lower P/E ratio. The P/E ratio can be seen as being expressed in years, [note 1] in the sense that it shows the number of years of earnings which would be required to pay back purchase price, ignoring inflation and time value of money. The P/E ratio also shows current investor demand for a company share. The reciprocal of the P/E ratio is known as the earnings yield.[3] The earnings yield is an estimate of the expected return from holding the stock if we accept certain restrictive assumptions (a discussion of these assumptions can be found here).

Contents |

Definition

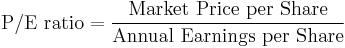

The P/E ratio is defined as:

However, the definition of its components may vary.

The price per share in the numerator is the market price of a single share of the stock. The earnings per share in the denominator depends on the type of P/E:

- "Trailing P/E" or "P/E ttm": Here earnings per share is the net income of the company for the most recent 12 month period, divided by the number of shares issued. This is the most common meaning of "P/E" if no other qualifier is specified. Monthly earning data for individual companies are not available, so the previous four quarterly earnings reports are used and earnings per share are updated quarterly. Note, each company chooses its own financial year so the timing of updates will vary from one to another.

- "Trailing P/E from continued operations": Instead of net income, this uses operating earnings, which exclude earnings from discontinued operations, extraordinary items (e.g. one-off windfalls and write-downs), or accounting changes. Note, longer-term P/E data, such as Shiller's, use net earnings.

- "Forward P/E", "P/Ef", or "estimated P/E": Instead of net income, this uses estimated net earnings over next 12 months. Estimates are typically derived as the mean of a select group of analysts (note, selection criteria is rarely cited). In times of rapid economic dislocation, such estimates become less relevant as the situation changes (e.g. new economic data is published, and/or the basis of forecasts becomes obsolete) more quickly than analysts adjust their forecasts.

For example, if stock A is trading at $24 and the earnings per share for the most recent 12 month period is $3, then stock A has a P/E ratio of 24/3 or 8. Put another way, the purchaser of the stock is paying $8 for every dollar of earnings. Companies with losses (negative earnings) or no profit have an undefined P/E ratio (usually shown as Not applicable or "N/A"); sometimes, however, a negative P/E ratio may be shown.

By comparing price and earnings per share for a company, one can analyze the market's stock valuation of a company and its shares relative to the income the company is actually generating. Stocks with higher (and/or more certain) forecast earnings growth will usually have a higher P/E, and those expected to have lower (and/or riskier) earnings growth will usually have a lower P/E. Investors can use the P/E ratio to compare the value of stocks: if one stock has a P/E twice that of another stock, all things being equal (especially the earnings growth rate), it is a less attractive investment. Companies are rarely equal, however, and comparisons between industries, companies, and time periods may be misleading.P/E ratio in general is useful for comparing valuation of peer companies in similar sector or group.

Since 1900, the average P/E ratio for the S&P 500 index has ranged from 4.78 in Dec 1920 to 44.20 in Dec 1999,[4] with an average around 15.[5] The average P/E of the market varies in relation with, among other factors, expected growth of earnings, expected stability of earnings, expected inflation, and yields of competing investments. For example, when US treasury bonds yield high returns, investors pay less for a given earnings per share and P/E's fall.

Share prices in a publicly traded company are determined by market supply and demand, and thus depend upon the expectations of buyers and sellers. Among these are:

- The company's future and recent performance, including potential growth;

- Perceived risk, including risk due to high leverage;

- Prospects for companies of this type, the market sector.

By dividing the price of one share in a company by the profits earned by the company per share, the P/E ratio is obtained. If earnings per share move proportionally with share prices the ratio stays the same. But if stock prices gain in value and earnings remain the same or go down, the P/E rises.

The earnings figure used is the most recently available, although this figure may be out of date and may not necessarily reflect the current position of the company. This is often referred to as a 'trailing P/E', because it involves taking earnings from the last four quarters.

The forward P/E uses the estimated earnings going forward twelve months.

P/E10 uses average earnings for the past 10 years. There is a view that the average earnings for a 20 year period remains largely constant,[6] thus using P/E10 will reduce the noise in the data.

The P/E ratio relates to the equity value. A similar measure can be defined for real estate, see Case-Shiller index.

PEG ratio is obtained by dividing the P/E ratio by the annual earnings growth rate. It is considered a form of normalization because higher growth rate should cause higher P/E.

The similar ratio on the enterprise value level is EV/EBITDA Enterprise value divided by the EBITDA.

Present Value of Growth Opportunities (PVGO) is another alternative method for stock valuation. Present value of growth opportunities is calculated by finding the difference between price of equity with constant growth and price of equity with no growth.

- PVGO = P(Growth) - P(No growth) = [D1/(r-g)] - E/r

where

- D1 = Dividend for next period

- r = Cost of Capital or the capitalization rate of the company

- E = Earning on equity

- g = The growth rate of the company.

Since the Price/Earnings (P/E) Multiple is 'Price per share / Earnings per share' it can be written as

- P0 / E1 = 1/r [ 1+ (PVGO/(E1/r))].

Thus, as PVGO rises, the P/E ratio rises.

Earnings yield

The reverse (or reciprocal) of the P/E is the E/P, also known as the earnings yield. The earnings yield is quoted as a percentage, and is useful in comparing a stock, sector, or the market's valuation relative to bonds.

The earnings yield is also the cost to a publicly traded company of raising expansion capital through the issuance of stock. Its computed as (EARNINGS PER SHARE/MARKET PRICE PER SHARE)

Price/dividend ratio

Publicly traded companies often make periodic quarterly or yearly cash payments to their owners, the shareholders, in direct proportion to the number of shares held. According to US law, such payments can only be made out of current earnings or out of reserves (earnings retained from previous years). The company decides on the total payment and this is divided by the number of shares. The resulting dividend is an amount of cash per share.

Just as P/E is the ratio of price to earnings, the Price/Dividend ratio is the ratio of price to dividend.

Dividend yield

The dividend yield is the dividend paid in the last accounting year divided by the current share price: it is the reciprocal of the Price/Dividend ratio.

If a stock paid out $5 per share in cash dividends to its shareholders last year, and its price is currently $50, then it has a dividend yield of 10%.

Historically, stocks with very high P/E ratios pay little if any dividends. Theoretically speaking, if the dividend exceeds the earnings, the company may be seen as returning capital to its investors, a situation that can not persist indefinitely.

Relationship between measures

Several of these measures are related to each other: given price, earnings, and dividend, there are 6 possible ratios, which come in reciprocal pairs:

- P/E ratio and earnings yield are reciprocals;

- P/D ratio and dividend yield are reciprocals;

- Dividend payout ratio (DPR) = Dividend/EPS, while the reciprocal is dividend cover (DC) = EPS/Dividend.

They are related by the following equations:

- P/E = P/D * DPR and P/D = P/E * DC;

- taking reciprocals, earnings yield = dividend yield * DC and dividend yield = earnings yield * DPR.

Interpretation

The average U.S. equity P/E ratio from 1900 to 2005 is 14 (or 16, depending on whether the geometric mean or the arithmetic mean, respectively, is used to average).

Normally, stocks with high earning growth are traded at higher P/E values. From the previous example, stock A, trading at $24 per share, may be expected to earn $6 per share the next year. Then the forward P/E ratio is $24/6 = 4. So, an investor is paying $4 for every $1 of earnings, which makes the stock more attractive than it was the previous year.

The P/E ratio implicitly incorporates the perceived risk of a given company's future earnings. For a stock purchaser, this risk includes the possibility of bankruptcy. For companies with high leverage (that is, high levels of debt), the risk of bankruptcy will be higher than for other companies. Assuming the effect of leverage is positive, the earnings for a highly-leveraged company will also be higher. In principle, the P/E ratio incorporates this information, and different P/E ratios may reflect the structure of the balance sheet.

Variations on the standard trailing and forward P/E ratios are common. Generally, alternative P/E measures substitute different measures of earnings, such as rolling averages over longer periods of time (to "smooth" volatile earnings, for example),[7] or "corrected" earnings figures that exclude certain extraordinary events or one-off gains or losses. The definitions may not be standardized.

Various interpretations of a particular P/E ratio are possible, and the historical table below is just indicative and cannot be a guide, as current P/E ratios should be compared to current real interest rates (see Fed model):

| N/A | A company with no earnings has an undefined P/E ratio. By convention, companies with losses (negative earnings) are usually treated as having an undefined P/E ratio, even though a negative P/E ratio can be mathematically determined. |

|---|---|

| 0–10 | Either the stock is undervalued or the company's earnings are thought to be in decline. Alternatively, current earnings may be substantially above historic trends or the company may have profited from selling assets. |

| 10–17 | For many companies a P/E ratio in this range may be considered fair value. |

| 17–25 | Either the stock is overvalued or the company's earnings have increased since the last earnings figure was published. The stock may also be a growth stock with earnings expected to increase substantially in future. |

| 25+ | A company whose shares have a very high P/E may have high expected future growth in earnings or the stock may be the subject of a speculative bubble. |

It is usually not enough to look at the P/E ratio of one company and determine its status. Usually, an analyst will look at a company's P/E ratio compared to the industry the company is in, the sector the company is in, as well as the overall market (for example the S&P 500 if it is listed in a US exchange). Sites such as Reuters offer these comparisons in one table. Example of SPY Often, comparisons will also be made between quarterly and annual data. Only after a comparison with the industry, sector, and market can an analyst determine whether a P/E ratio is high or low with the above mentioned distinctions (i.e., undervaluation, over valuation, fair valuation, etc.).

Using Discounted cash flow analysis, the impact of earnings growth and inflation can be evaluated. Using constant historical earnings growth rate of 3.8 and post-war S&P 500 returns of 11% (including 4% inflation) as the discount rate, the fair P/E is obtained as 14.42. A stock growing at 10% for next 5 years would have a fair P/E of 18.65.

The market P/E

To calculate the P/E ratio of a market index such as the S&P 500, it is not accurate to take the "simple average" of the P/Es of all stock constituents; since it is a capitalization-weighted index, the accurate method is to calculate a weighted average. In this case, each stock's underlying market cap (price multiplied by number of shares in issue) is summed to give the total value in terms of market capitalization for the whole market index. The same method is computed for each stock's underlying net earnings (earnings per share multiplied by number of shares in issue). In this case, the total of all net earnings is computed and this gives the total earnings for the whole market index. The final stage is to divide the total market capitalization by the total earnings to give the total market P/E ratio. The reason for using the weighted average method rather than 'simple' average can best be described by the fact that the smaller constituents have less of an impact on the overall market index. For example, if a market index is composed of companies X and Y, both of which have the same P/E ratio (which causes the market index to have the same ratio as well) but X has a 9 times greater market cap than Y, then a percentage drop in earnings per share in Y should yield a much smaller effect in the market index than the same percentage drop in earnings per share in X. One easy way of looking up a market index P/E ratio is to look up the P/E ratio of an exchange-traded fund that tracks the index. For example SPY tracks the S&P 500 Index, while VTI tracks the Wilshire 5000 index.

A variation that is often used is to exclude companies with negative earnings from the sample - especially when looking at sub-indices with a lower number of stocks where companies with negative earnings will distort the figures.

In Stocks for the Long Run, Jeremy Siegel argues that the earnings yield is a good indicator of the market performance on the long run. The average P/E for the past 130 years has been 12.1 (i.e. earnings yield 8.3 percent).

Inputs

Accuracy and context

In practice, decisions must be made as to how to exactly specify the inputs used in the calculations.

- Does the current market price accurately value the organization?

- How is income to be calculated and for what periods? How do we calculate total capitalization?

- Can these values be trusted?

- What are the revenue and earnings growth prospects over the time frame one is investing in?

- Were there special one-time charges which artificially lowered (or artificially raised) the earnings used in the calculation, and did those charges cause a drop in stock price or were they ignored?

- Were these charges truly one-time, or is the company trying to manipulate us into thinking so?

- What kind of P/E ratios is the market giving to similar companies, and also the P/E ratio of the entire market?

- Are P/E ratios an accurate measure?

Historical vs. Projected Earnings

A distinction has to be made between the fundamental (or intrinsic) P/E and the way we actually compute P/Es. The fundamental or intrinsic P/E examines earnings forecasts. That is what was done in the analogy above. In reality, we actually compute P/Es using the latest 12 month corporate earnings. Using past earnings introduces a temporal mismatch, but it is felt that having this mismatch is better than using future earnings, since future earnings estimates are notoriously inaccurate and susceptible to deliberate manipulation.

On the other hand, just because a stock is trading at a low fundamental P/E is not an indicator that the stock is undervalued. A stock may be trading at a low P/E because the investors are less optimistic about the future earnings from the stock. Thus, one way to get a fair comparison between stocks is to use their primary P/E. This primary P/E is based on the earnings projections made for the next years to which a discount calculation is applied.

The P/E ratio in business culture

The P/E ratio of a company is a significant focus for management in many companies and industries. This is because management is primarily paid with their company's stock (a form of payment that is supposed to align the interests of management with the interests of other stock holders), in order to increase the stock price. The stock price can increase in one of two ways: either through improved earnings or through an improved multiple that the market assigns to those earnings. As mentioned earlier, a higher P/E ratio is the result of a sustainable advantage that allows a company to grow earnings over time (i.e., investors are paying for their peace of mind). Efforts by management to convince investors that their companies do have a sustainable advantage have had profound effects on business:

- The primary motivation for building conglomerates is to diversify earnings so that they go up steadily over time.

- The choice of businesses which are enhanced or closed down or sold within these conglomerates is often made based on their perceived volatility, regardless of the absolute level of profits or profit margins.

- One of the main genres of financial fraud, "slush fund accounting" (hiding excess earnings in good years to cover for losses in lean years), is designed to create the image that the company always slowly but steadily increases profits, with the goal to increase the P/E ratio.

These and many other actions used by companies to structure themselves to be perceived as commanding a higher P/E ratio can seem counterintuitive to some, because while they may decrease the absolute level of profits they are designed to increase the stock price. Thus, in this situation, maximizing the stock price acts as a perverse incentive.

Recent historic values

There is no theoretically ideal P/E ratio for a company. For instance, the Alternative Investment Market in London comprises mining companies like Talvivaara with P/E ratio exceeding 99000 in late November 2008.

Here are the recent year end values of the S&P 500 index and the associated P/E as reported.[8] For a list of recent contractions (recessions) and expansions see US Business Cycle Expansions and Contractions.

| Date | Index | P/E | EPS growth % | Comment |

|---|---|---|---|---|

| 2009-06-30 | 919.32 | 122.41 | -- | |

| 2009-03-31 | 797.87 | 116.31 | -- | |

| 2008-12-31 | 903.25 | 60.70 | -- | |

| 2007-12-31 | 1468.36 | 22.19 | 1.4 | |

| 2006-12-31 | 1418.30 | 17.40 | 14.7 | |

| 2005-12-31 | 1248.29 | 17.85 | 13.0 | |

| 2004-12-31 | 1211.92 | 20.70 | 23.8 | |

| 2003-12-31 | 1111.92 | 22.81 | 18.8 | |

| 2002-12-31 | 879.82 | 31.89 | 18.5 | |

| 2001-12-31 | 1148.08 | 46.50 | -30.8 | 2001 contraction resulting in P/E Peak |

| 2000-12-31 | 1320.28 | 26.41 | 8.6 | Dot-com bubble burst: March 10, 2000 |

| 1999-12-31 | 1469.25 | 30.50 | 16.7 | |

| 1998-12-31 | 1229.23 | 32.60 | 0.6 | |

| 1997-12-31 | 970.43 | 24.43 | 8.3 | |

| 1996-12-31 | 740.74 | 19.13 | 7.3 | |

| 1995-12-31 | 615.93 | 18.14 | 18.7 | |

| 1994-12-31 | 459.27 | 15.01 | 18.0 | Low P/E due to high recent earnings growth. |

| 1993-12-31 | 466.45 | 21.31 | 28.9 | |

| 1992-12-31 | 435.71 | 22.82 | 8.1 | |

| 1991-12-31 | 417.09 | 26.12 | -14.8 | |

| 1990-12-31 | 330.22 | 15.47 | -6.9 | July 1990-March 1991 contraction. |

| 1989-12-31 | 353.40 | 15.45 | . | |

| 1988-12-31 | 277.72 | 11.69 | . | Bottom (Black Monday was Oct 19, 1987) |

Note that at the height of the Dot-com bubble P/E had risen to 32. The collapse in earnings caused P/E to rise to 46.50 in 2001. It has declined to a more sustainable region of 17. Its decline in recent years has been due to higher earnings growth.

During 1920-1990, the P/E ratio was mostly between 10 and 20, except for some brief periods.[9] Jeremy Siegel has suggested that the average P/E ratio of about 15 (or earnings yield of about 6.6%) arises due to the long term returns for stocks of about 6.8%.

Jeremy Siegel in Stocks for the Long Run, (2002 edition) had argued that with the favorable developments like the lower capital gains tax rates and transaction costs, P/E ratio in "low twenties" is sustainable, although higher than the historic average.[10]

See also

Notes

- ^ Price is in currency or currency/share, while earnings are in currency/year, or currency/share/year.

References

- ^ a b c Shiller, Robert (2005). Irrational Exuberance (2d ed.). Princeton University Press. ISBN 0-691-12335-7.

- ^ "Price-Earnings Ratio (P/E Ratio)". Investopedia. http://www.investopedia.com/terms/p/price-earningsratio.asp. Retrieved 2007-12-31.

- ^ Stocks for the Long Run, by Jeremy J. Siegel, McGraw-Hill Companies; 2nd edition (March 1, 1998) (Old edition) New edition is Siegel, Jeremy J. (2007). Stocks for the Long Run, 4th Edition. New York: McGraw-Hill. unknown pages for citation. ISBN 978-0071494700.

- ^ "Seeking Alpha blog comment...". http://seekingalpha.com/article/124295-s-p-p-e-ratio-is-low-but-has-been-lower.

- ^ "Is the S&P 500 Index now over-valued? What Return Can You Reasonably Expect From Investing in the S&P 500 Index?". investorsfriend.com. http://www.investorsfriend.com/S%20and%20P%20500%20index%20valuation.htm. Retrieved 18 December 2010.

- ^ Adam Barth. "11% Solution - Overvalued Stock Market". generationaldynamics.com. http://www.generationaldynamics.com/cgi-bin/D.PL?d=ww2010.i.050711eleven.

- ^ Anderson, K.; Brooks, C. (2006). The Long-Term Price-Earnings Ratio. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=739664.

- ^ "S&P 500 Earnings and Estimate Report". http://www2.standardandpoors.com/spf/xls/index/SP500EPSEST.XLS.

- ^ Is the P/E Ratio a Good Market-Timing Indicator?

- ^ NAREIT - Capital Markets